Pánské lyžařské kalhoty Salomon Edge Pant M LC2150800 - surf the web (prodloužená délka) - Sportovna

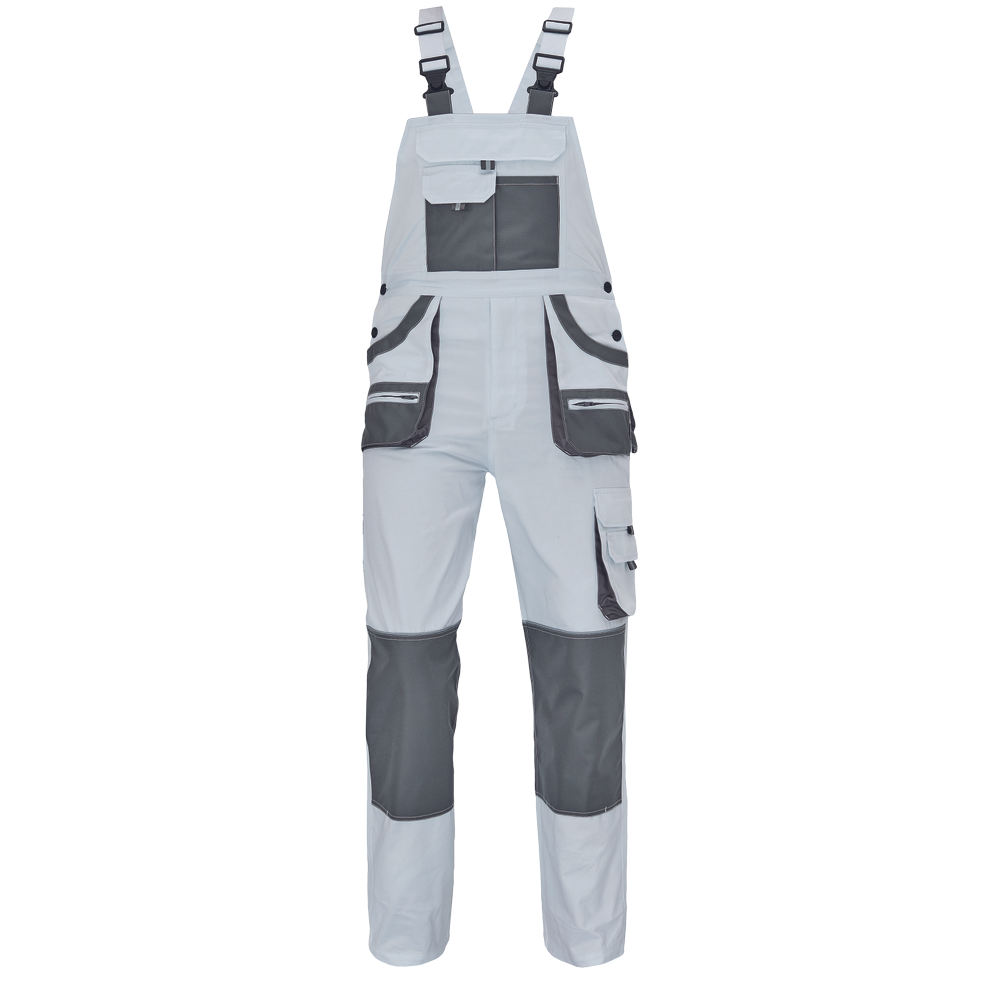

Montérkové kalhoty s laclem DASSY BOLT - 295 - upravená délka / Pracovní oděvy DASSY - Kalhoty s laclem DASSY /

Canis CXS Montérky pracovní s laclem SIRIUS TRISTAN prodloužená délka šedo-zelené od 520 Kč - Heureka.cz