ᐅ LG V30 (6,0''; 2880x1440; 64GB; 4GB; kolor srebrny ) - Ceny, opinie, dane techniczne | VideoTesty.pl

Karta pamięci do aparatu Goodram microSDHC 16GB Class 10 UHS-I (SDU16GHCUHS1AGRR10) - Ceny i opinie na Ceneo.pl

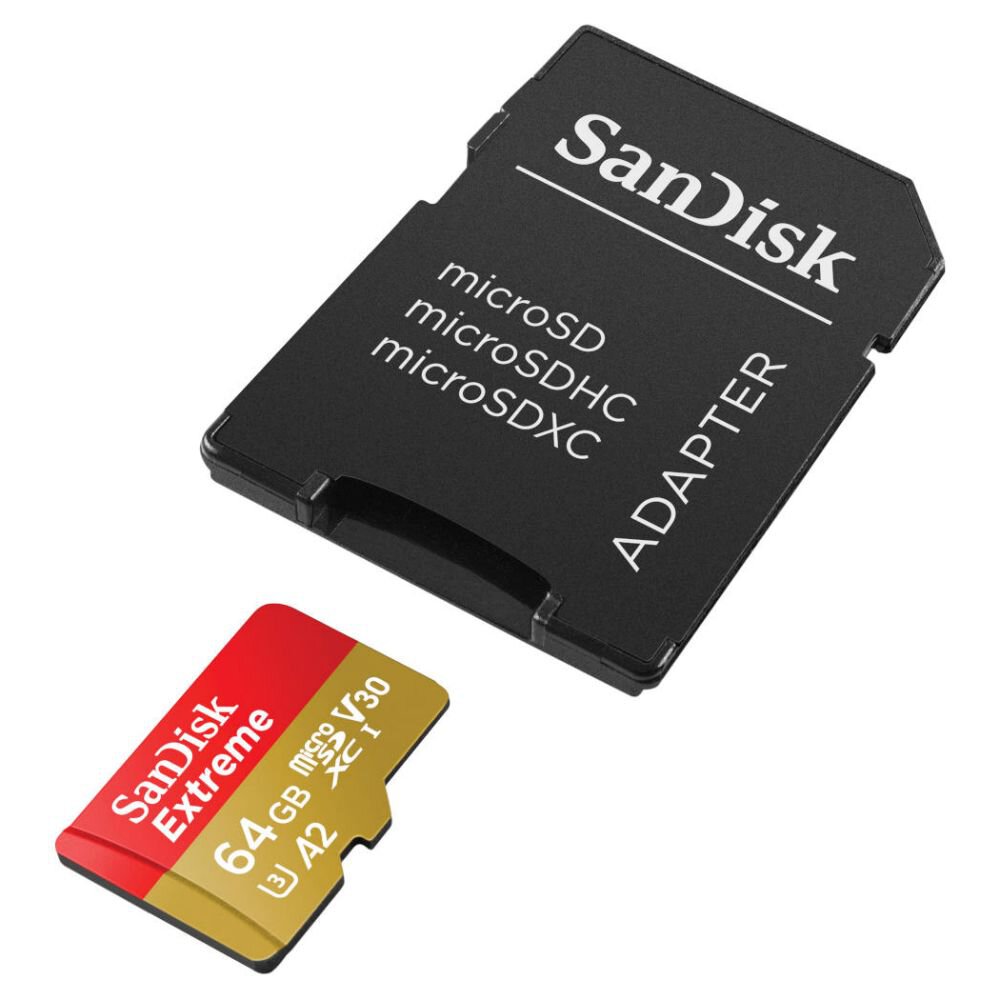

Baltrade.eu - B2B shop - SanDisk microSD (microSDXC) 64GB Extreme 170/80MB/s UHS-I U3 V30 A2 memory card

ᐅ LG V30 (6,0''; 2880x1440; 64GB; 4GB; kolor srebrny ) - Ceny, opinie, dane techniczne | VideoTesty.pl

Karta pamięci do aparatu SanDisk microSDXC 256GB Extreme PRO V30 Class 10 (SDSQXCZ256GGN6MA) - Ceny i opinie na Ceneo.pl